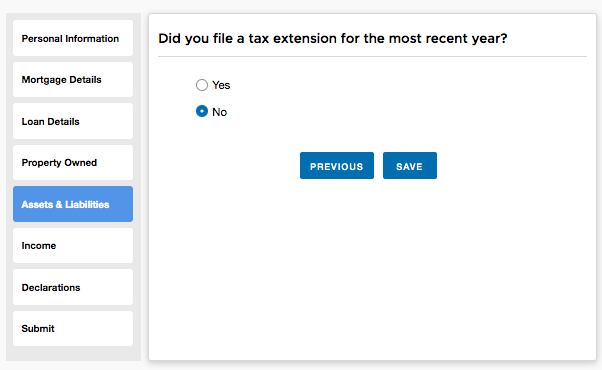

PerfectLO has pre-built questionnaires with workflows to fit all of your specific companies needs.

“NOT YOUR TYPICAL FILL IN THE BLANK 1003”

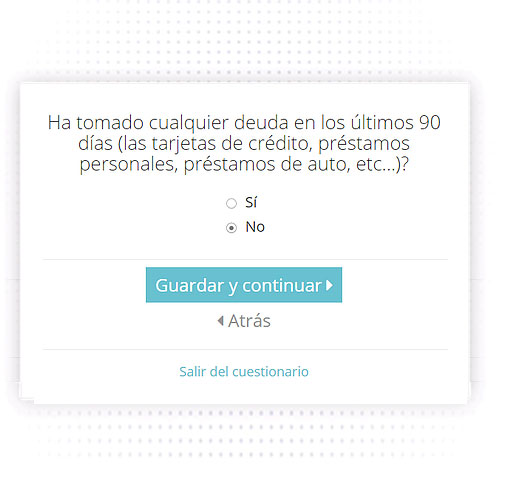

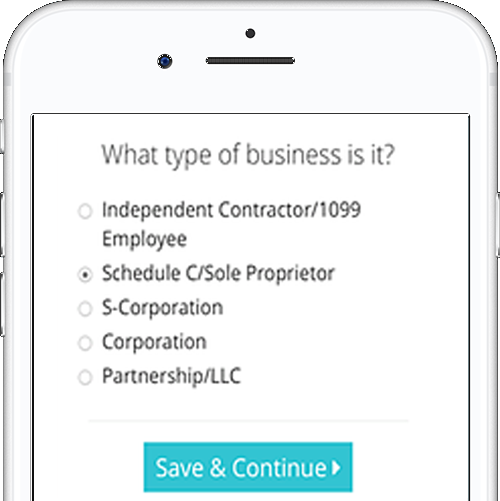

The founders of PerfectLO knew there was a better way to initiate the mortgage process. They used their extensive industry knowledge to construct a detailed, interactive questionnaire that systematically and intelligently asks all the right questions. No more inaccurate loan applications due to assumptions or inadequate fact-finding. No more unnecessary credit pulls or wasted time and money on loans that will never be closed. No more missed questions that require additional documentation.

The result is a simplified and streamlined process that leads to clean and accurate approvals.

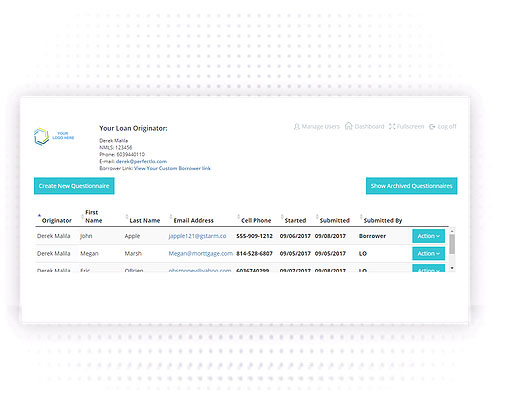

PerfectLO is a cloud-based mortgage software that solves one of the biggest problems during the loan application process: failure to provide the detailed information to complete a Borrower’s true profile.

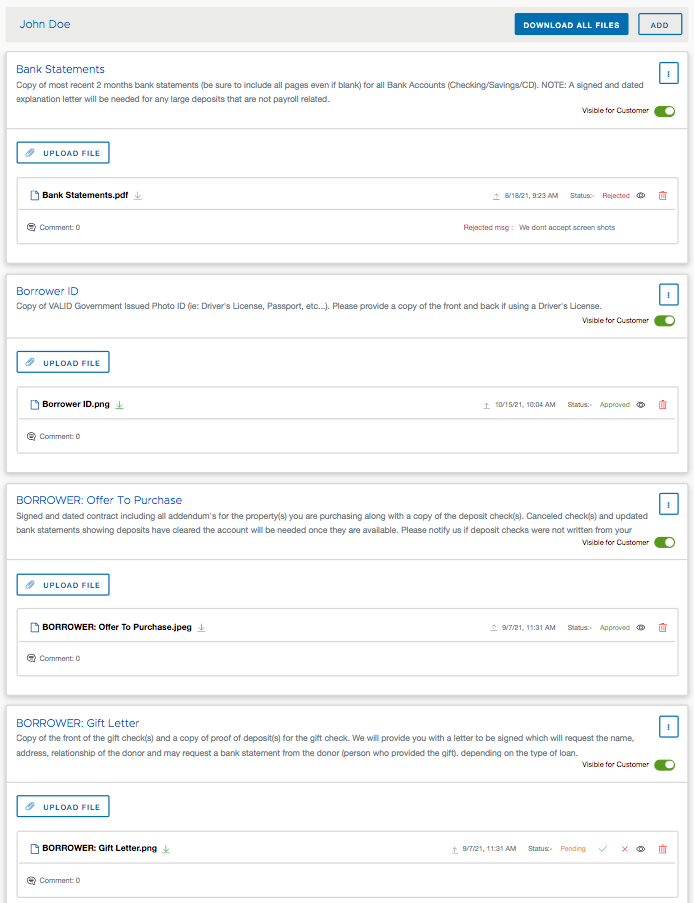

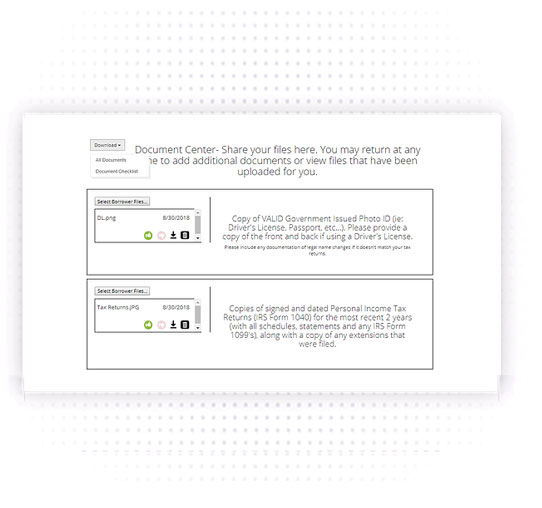

This interactive questionnaire assumes nothing and fact finds every detail known to loan kind. It provides a detailed document checklist to the borrower based on their answers, imports into your current LOS system, provides text/email notifications, an easy to read document for the LO with all of the borrower’s answers and a Document Center for securely downloading and uploading documents between the Borrower and LO.

PerfectLO’s simplified process saves you money from unnecessary credit pulls and wasting time working to resolve issues you should have never seen. It prevents inaccurate loan applications and produces happy clients all while creating lifelong accounts without triggering TRID, if you wish. You also own ANY and ALL your data from when a borrower starts the process and can also take your pipeline with you.

Learn More

PerfectLO makes my job a whole lot easier! My processor loves it more than I do! Must have for any LO

Great program and excellent customer support